Benefits administration

Enrich the benefits experience for everyone in your organization with a solution that helps streamline administration, control costs and attract and retain talent.

Already using ADP? Sign in or get support.

Become an employer of choice with innovative, yet simple, benefits administration

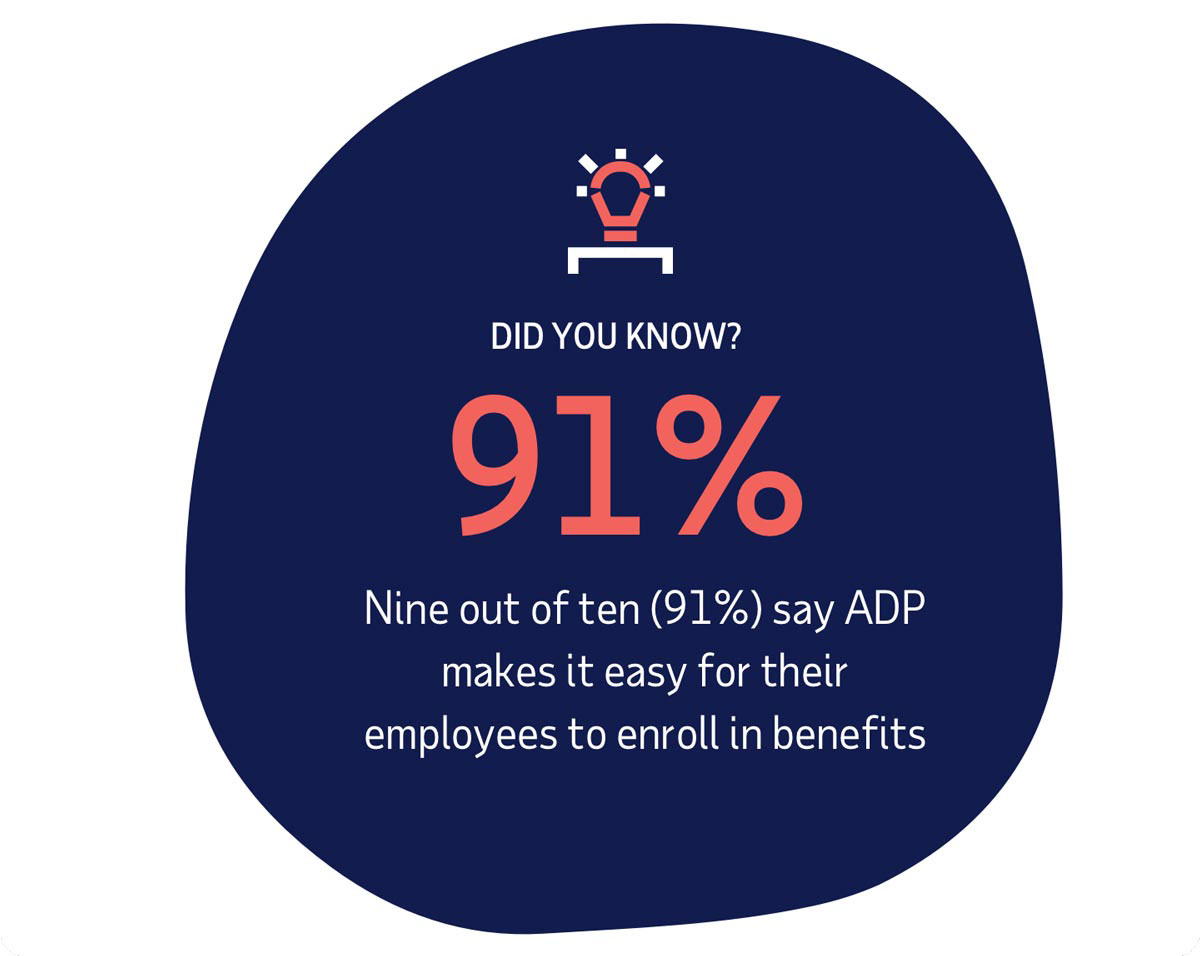

Benefits are essential to attracting and retaining talent. But for that to happen, benefits administration has to be easy and engaging, both for employees and HR practitioners. ADP delivers such capabilities and much more.

With an industry-leading mobile experience and seamless carrier integrations, you can help make it simpler and more convenient for your people to manage their benefits. Plus, you’ll have access to deep insights that can help you understand changing employee preferences and advanced technology to adapt accordingly.

See our benefits administration capabilities

Easily adapt as benefits expectations change

Meet the needs of multiple generations of employees and keep pace with the latest benefits trends – workplace flexibility, mental health, childcare and more – all while simplifying administration. Advanced benefits capabilities from ADP can help you:

- Engage employees – Make it easy for your employees to navigate open enrollment, add dependents and manage life events right from their mobile device or our website.

- Personalize benefit decisions – Help employees choose the benefits that best fit their needs with guided, interview-based support.

- Integrate technology – Integrate your benefits administration with top carriers and leading payroll, HR and financial systems, including most ERPs, to help increase efficiency, accuracy and security.

- Manage voluntary benefits – Easily administer your voluntary benefits via automatic payroll deductions.

- Retain talent – Show employees the true value of your investment in their well-being and future with total rewards statements.

Guide decisions and understand their impact

Optimize your benefits and empower employees to make more informed decisions. By leveraging ADP’s true intelligence, powerful analytics and benchmark data, you can:

- View trends in employer costs, enrollment preferences and enrolled coverages.

- Help employees make better, more confident benefits decisions.

- Measure system utilization, employee engagement and effectiveness of open enrollment.

- Identify differences in engagement and benefits choices among employee segments.

- Compare enrollment performance and benefit design to other organizations.

- Evaluate plan dimensions – contributions, estimated costs, access to care, etc.

Streamline administration with help from experts

Rely on our benefits specialists to help you ease administrative burdens and fill knowledge gaps so you can focus on more strategic initiatives. Support services include:

- Dedicated service representatives – Benefits professionals assist you with open enrollment setup, technology best practices and benefits strategy.

- Compliance – Best practice guidance can help support your efforts to comply with the Affordable Care Act, leaves of absence and other federal, state or local regulations.

- Dependent verification – Point-in-time and ongoing validation of dependent eligibility helps prevent you from paying for dependents who are not entitled to health coverage.

- Print and fulfillment – Trust us to handle design, data management, print-on-demand capabilities and mailing services on your behalf.

- Employee communication services – Our team can help you create and execute targeted communication strategies to drive employee awareness of your benefits.

Want to reduce the burden of complex HR administration beyond just benefits? Learn about our range of outsourcing options.

How ADP works with others like you

Now, all that information is at an employee’s fingertips and they can understand their coverage, what they’ve chosen, who’s eligible and who their dependents are. From a day-to-day activity perspective, our benefits team especially has seen a big change in the types of questions they’re now being asked.

Mary Tyrone Senior HR Director, Conair Corporation

How ADP works with others like you

When I realized we needed to prepare and remit Forms 1094-C and 1095-C for the first time last year, I started to panic. ADP had been handling our payroll for the past eight years so it was a no-brainer to have them help with ACA compliance … it really took a load off my shoulders — and the process was seamless.

Rhonda S. Gearlds Corporate Compensation and Benefits Administrator, Sumitomo Electric Wiring Systems

Commonly asked questions about benefits

What are the top 10 employee benefits?

Generous benefits packages can help employers retain valued employees and attract new talent. Some of the benefits most desired by employees today include:

- Health insurance

- Paid time off (vacation, holiday, sick day)

- Retirement savings plans

- Dental insurance

- Life insurance

- Vision insurance

- Paid family and medical leave

- Flexible schedules

- Tuition reimbursement

- Financial wellness services

What are some examples of benefits?

Benefits tend to fall into two categories – traditional and unique. Examples of traditional benefits include health and dental care, life insurance and retirement savings plans. Unique benefits, on the other hand, consist of education assistance, paid parental leave, telecommuting and more. Employers who succeed in keeping their employees engaged often find the right mix of both types of benefits.

What does benefit provider mean?

A benefit provider is an organization that charges premiums in exchange for health care coverage or other services. When shopping for benefit providers, businesses have several options – consult a broker, work with insurance carriers directly or join a professional employer organization (PEO) that will negotiate the contract and administer the benefits on its behalf. From the employee’s perspective, the group benefits provider is often the employer.

What are the four types of compensation?

The four types of direct compensation are hourly pay, salaries, commission and bonuses. Benefits packages fall under indirect compensation, which in some cases, is just as valuable to employees as their paychecks when they decide whether to work for an employer.

What are ERISA requirements?

The Employee Retirement Income Security Act (ERISA) requires that private industry employers who have voluntarily established retirement and group health plans perform the following:

- Disclose important information to participants about plan features, including funding, benefits offered and plan limitations

- File reports with the Department of Labor (DOL) and the IRS that describe coverage levels, claims procedures and plan modifications

- Establish a grievance and appeals process for when claims are denied

Keep in mind that an employer is not required to provide retirement or group health plans.

Resources and insights

guidebook

Employee Financial Wellness Programs: Employer Guide

guidebook

Group health benefits and business insurance simplified

guidebook