Simpler, smarter small business payroll backed by the experts

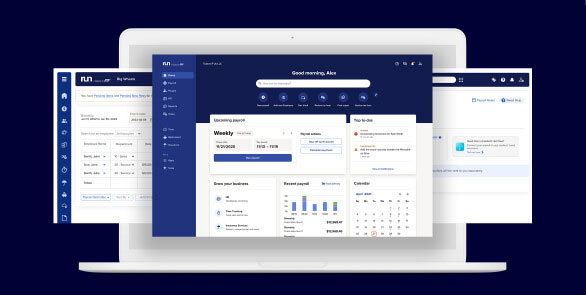

Get payroll done faster and tax filing done for you with a modern platform and direct access to payroll experts, designed to make paying your people easier than ever before.

Get 6 months FREE payroll* * See terms & conditions

Already using ADP? Sign in or get support.

See how easy small business payroll and HR can be

Pay your people in just minutes, with an intuitive platform.

Convenient HR and hiring tools also help you grow and manage your team.

1 Minute Overview

ADP has reimagined what’s possible, to make running payroll and HR better than ever before.

Find your perfect small business payroll solution

You've got options — choose the RUN Powered by ADP® package that fits your business best.

Essential Payroll

Perfect for startups and established companies that simply need payroll, taxes, and help with compliance they can trust.

Enhanced Payroll

Adds powerful capabilities on top of payroll, such as garnishment payment service, SUI management, background checks, and job posting through ZipRecruiter®1.

Complete Payroll & HR+

Includes ADP’s latest HR tools such as live HR support, employee handbook wizard, proactive compliance alerts, HR guidance and forms, and a job description wizard.

HR Pro Payroll & HR

Offers a comprehensive suite of HR tools such as a proactive HR support team, employer/employee training, business advice, and legal assistance from Upnetic Legal Services®2.

Small business payroll that’s fast, smart and easy

Full-Service Payroll & Tax Filing

Payroll done faster, tax filing done for you

It’s not easy running a small business. We’re here with the payroll and tax solutions and support you need, when and how you need them:

- Process payroll in minutes, at your desk or on the move — or set it to autopilot

- Payroll taxes calculated, deducted and paid automatically for you

- Quarterly and annual reporting done for you

- Forms W-2 and 1099 created and delivered for you, and even e-filed with the IRS on your behalf.

- Easily integrate time tracking, scheduling and job costing

- IRS inquiries handled for you

- Manage your state unemployment insurance (SUI), including claims administration and reviewing your account for erroneous charges.

Confidence & Compliance

Help avoid costly mistakes before they happen

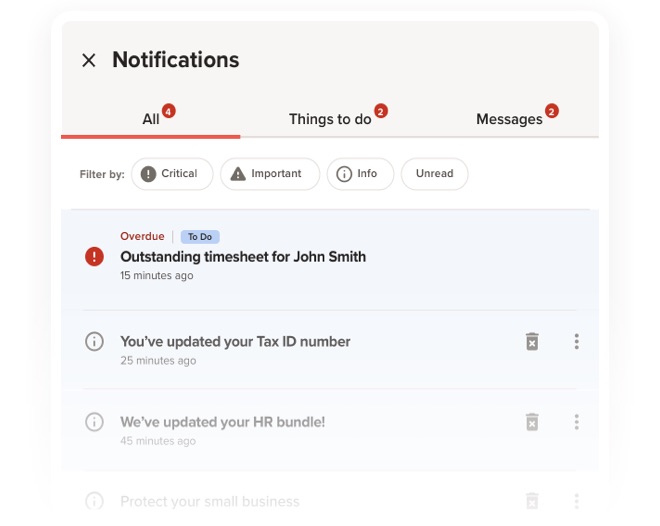

We help you stay on top of tax laws and regulations. Our solutions include the latest updates across all 50 states and intelligent tech that flags possible errors for you. We can help you stay compliant with payroll and tax requirements, wage and hour laws, new hire reporting and much more.

Plus, our world-class global security organization helps ensure that your and your employees’ data is safe and secure.

EXPERT SERVICE & SUPPORT

Always have peace of mind with 24/7 support

We know it's not easy running a small business, so we're here to help you get the answers you need, when and how you need them. Call or chat anytime, or find answers at your fingertips with a robust online help center that makes it easy to search for information like how-to guides and support articles.

EMPLOYEE EXPERIENCE

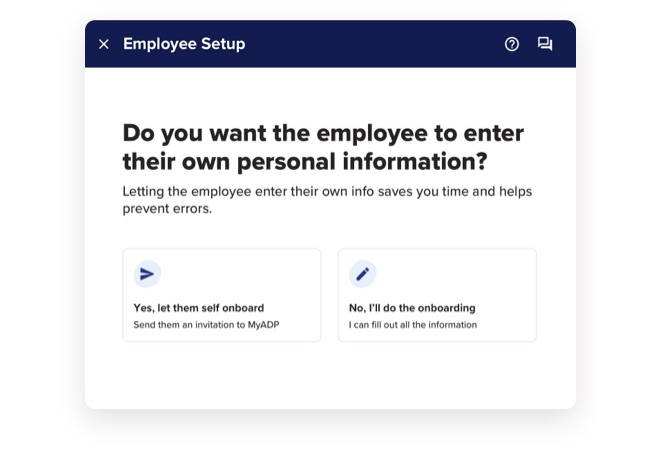

Give your employees the experience they deserve

Save time and empower your team with easy-to-use digital tools and meaningful perks, including simple, self-managed onboarding and flexible pay options.

Why companies choose ADP small business payroll software

Over 900,000 small business clients trust ADP® to deliver a better payroll experience. Our small business expertise and easy-to-use tools simplify payroll and HR, so you can stay focused on the work that matters most.

9/10

customers tell us switching to ADP is easy and has made their jobs easier

3/4

customers spend 15 minutes or less running payroll through ADP

9/10

customers say ADP helps their company comply with payroll tax laws and regulations

Internal survey of 3,099 RUN Powered by ADP® customers in 2025.

Getting started with payroll is easy

Set up in just three simple steps.

1

Begin the guided setup process

We'll let you know what information to have handy before you start.

2

Count on us for support

Our experts are available to help you set up payroll, benefits, and more.

3

We'll confirm you're ready to run payroll

Once you're up and running, we'll have your back with 24/7 payroll support.

Sync it all with small business payroll

Everything you need in one, integrated platform — like health insurance, retirement solutions, time tracking, workers’ comp and more — designed to work seamlessly together within RUN Powered by ADP.

Plus, integrate ADP with your favorite accounting, POS, HR and business software.

Compare packagesMEET OUR CLIENTS

Working and running payroll used to take hours, and now it only takes about one hour per week. Now I concentrate on running my business instead of worrying about payroll. As a partner, ADP has given me back the time and freedom I need to run my business. For me, that’s invaluable.

Daniel Stover Owner and Director, Antigravity NTF

MEET OUR CLIENTS

What I love about RUN is how simple it is to process my payroll, removing that worry from week to week. RUN’s phenomenal tools and resources help me solve my problems quickly whenever I encounter an issue. It makes being a small business owner easier.

Shalena Brown-Best Owner and CEO, Elements Massage

MEET OUR CLIENTS

RUN’s platform is very intuitive and easy to use. I can do almost everything myself, but ADP’s excellent customer service helped with prompt response when I’ve had an issue requiring assistance.

Mark Picillo General Manager, United Check Cashing

MEET OUR CLIENTS

As a small business, we don't have a full HR/accounting department as there is no need. RUN helps us use our time more efficiently and effectively by providing tools we wouldn't otherwise have at our fingertips. It's almost like having an extra employee.

Paula Dalby Office Manager, JIBE

Join over 900,000 small business clients that count on ADP for faster, smarter, easier payroll

Get PricingRESOURCES FOR YOU

Expert payroll insights for small business owners

insight

Payroll checklist for small businesses

guidebook

How to choose a payroll provider for your business

insight

Switching payroll providers: what you need to know

VIEW MORE SMALL BUSINESS RESOURCES

Paying Your PeopleMaintaining Compliance

Recruiting & Hiring

Outsourcing HR

Small business payroll FAQs

How much does small business payroll cost?

The cost of small business payroll depends on several factors, including payroll frequency, total number of employees and the specific services that are needed. Most commonly, there is a per-payroll processing fee and an annual base fee. The important thing to remember is that a payroll service may actually save you money when compared to the cost of tax penalties. ADP will work with you to determine the right payroll setup for your business, whether you have just one employee or several.

Who does payroll for a small business?

In some small businesses, especially those in their infancy, the owner manages the payroll. However, this approach can quickly become unfeasible due to the amount of time it takes to manually process payroll and the costly penalties that can possibly ensue if mistakes are made. Consequently, many small business owners eventually turn to a payroll service provider for assistance.

How do small businesses run payroll?

Whether you choose to tackle the job on your own or work with a professional, running small business payroll, in its most basic form, consists of these steps:

- Track and record employee hours worked

- Calculate wages and withholding amounts (taxes, benefits, etc.)

- Distribute wages to employees

- Deposit the withheld taxes with appropriate government agencies

- File employer tax returns at the applicable deadlines

- Send employees Form W-2 and other required tax forms

- Throughout each stage of this process, you’ll need to comply with constantly changing regulations – a task that can be difficult without the expertise and assistance of a payroll provider like ADP.

What does payroll software for small business include?

Depending on the provider’s capabilities, small business payroll software may include:

- The ability to process payroll from any device, anywhere

- Taxes calculated, paid and filed on your behalf with proper authorization

- Employee self-service and flexible payment options

- Intelligent technology that helps flag potential errors

- Specialized support navigating some laws and regulations

What are the benefits of using small business payroll software?

Saving time is one of the primary reasons small businesses use payroll software. It also provides peace of mind that employees will be paid quickly and accurately via their preferred method of payment. As a result, you can focus more attention on improving your product or service, growing your customer base, and other initiatives that generate revenue.

Does small business payroll software save your business money?

Tax penalties and fines resulting from payroll errors can be expensive. By helping minimize or eliminate these mistakes, payroll software may save you money. Software also automates the payroll process, which may reduce labor expenses associated with running payroll.

Do you offer payroll in my state?

Yes, ADP offers payroll services in all 50 states. So, whether your business is based on the East Coast, West Coast, Midwest or one of the noncontiguous states, we’ve got you covered.

How do I get set up on ADP?

You can be set up on ADP’s small business payroll in two easy steps:

- Provide us with your payroll records, including information about your company, your employees and their jobs, and state and local regulations.

- Notify the IRS that you’ve chosen to work with ADP as your payroll service by completing Form 8655, Reporting Agent Authorization.

What are all the things I can do with ADP payroll?

ADP’s small business payroll is automated, which means there’s minimal effort needed on your part. Here are some of the things our payroll service handles behind the scenes.

- Calculate hours worked and gross pay

- Process payroll deductions, including taxes, benefits, garnishments, etc.

- Calculate net wages and pay employees

- File tax reports with federal, state and local government agencies

- Document and store payroll records securely

How many times can I run payroll per month?

The frequency with which you can run payroll depends on your industry and state regulations. ADP generally recommends weekly or biweekly pay periods where acceptable. We’ll work with you to create a payroll calendar that suits your business and compliance needs.

How will my employees get their paystubs?

Depending on your state’s regulations, your employees may be able to access their pay statements electronically. Or, you may be required to provide them with printed pay statements. ADP’s small business payroll supports both versions.

What’s included in employee accounts?

Employee self-service is included with ADP’s small business payroll. After logging into their account, your employees can access their pay statements, update their contact information and manage their withholdings.

Does ADP file Form W-2 and Form 1099?

We’ll create and deliver W-2 and 1099 forms for you, and even e-file these forms with the IRS on your behalf.

Your privacy is assured.

Your privacy is assured.

- ZipRecruiter is a registered trademark of ZipRecruiter, Inc.

- Legal services are provided by Upnetic Legal Services, a third-party provider

- All insurance products will be offered and sold only through Automatic Data Processing Insurance Agency, Inc.,(ADPIA) its licensed agents or its licensed insurance partners, One ADP Blvd. Roseland, NJ 07068. CA license #0D04044. Licensed in 50 states. ADPIA is an affiliate of ADP, Inc.

- Internal survey of 1,776 RUN Powered by ADP® customers in 2022.