Pay Statement Requirements: State and Territory Laws and Regulations

Current as of January 10, 2025.

A pay statement (also known as a pay stub, check stub or wage statement) provides pay information to employees and generally includes:

- the employer's name

- hours worked

- pay rates

- gross earnings

- taxes

- deductions

- net earnings, and

- paid time off information.

The laws requiring employers to include specific information on pay statements vary from state to state and may be different based on employee occupation or method of compensation. The penalties for non-compliance can be significant. It is, therefore, important to understand the requirements and recognize the differences.

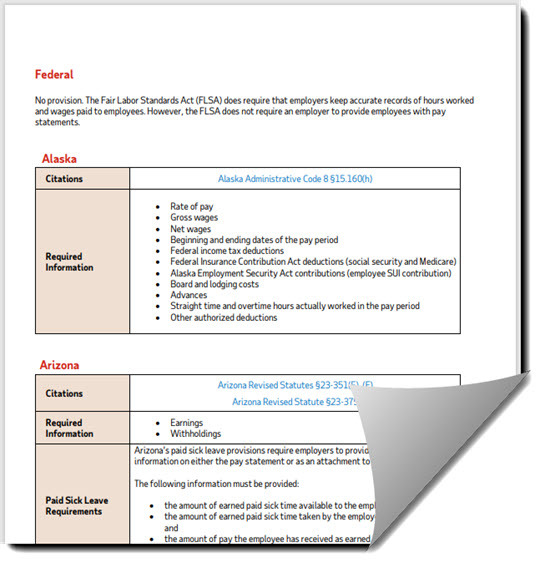

As a starting point, we have developed the chart linked below covering state and territory laws and regulations governing pay statement requirements.

Pay Statement Requirements

Download the latest chart detailing pay statement requirements for states and territories.

This information is provided with the understanding that ADP is not rendering legal advice.