Your Roadmap to Claiming R&D Tax Credits

Is your business undertaking research and development (R&D) activities? If so, you may be eligible for the R&D tax credit.

In 2015, the Protecting Americans from Tax Hikes (PATH) Act expanded (and permanently extended) the R&D tax credit to encourage small businesses to invest in research and development activities.

According to the Internal Revenue Code (IRC Section 41), the following expenses—when related to qualified R&D activities performed in the United States—are eligible for the R&D tax credit:

- Wages paid to employees performing the R&D activities

- Supplies (tangible, raw materials) used to conduct the activities

- Cloud computing expenses used to develop qualified software

- Amounts paid to contractors involved in the R&D activities

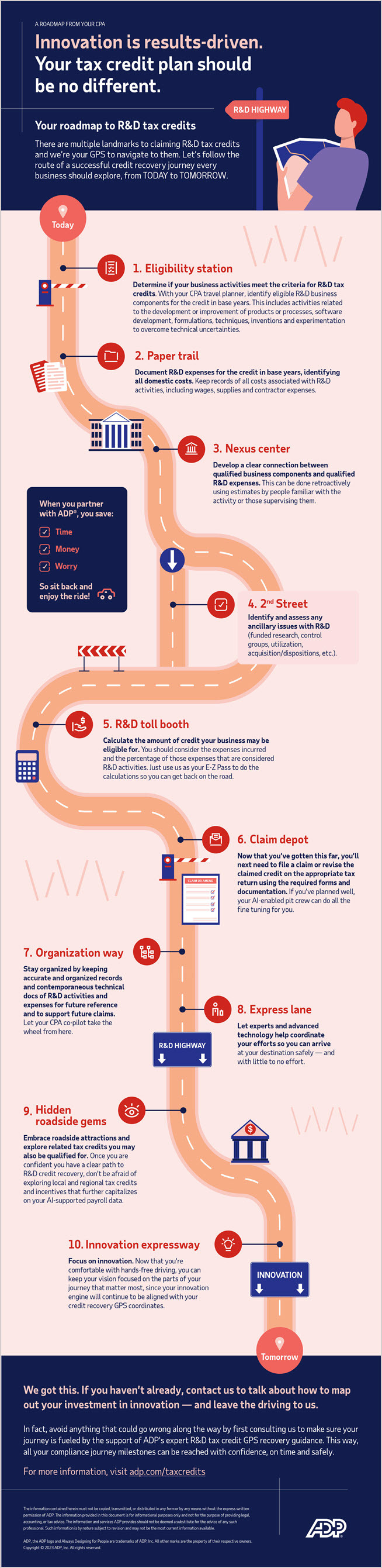

Follow the R&D tax credit claims journey illustrated by the infographic below. Open the full-sized infographic on a new page.

Learn more

Did you know there's nearly $15B in R&D tax credits available to help both both large and small businesses? Get more information.