Decoding High-Deductible Health Plans (HDHPs) and HSA-Compatible Plans

Thanks to ADP Marketplace partner HealthEquity for this article.

Selecting the right health benefits is a big decision for employers, impacting both employee wellbeing and the company bottom line.

The options may seem overwhelming, but understanding the differences between traditional and health savings account-compatible plans can help you make an informed choice that meets both your company's and employees' needs.

The basics: defining health plans and their components

To effectively compare traditional health plans with HSA-compatible ones, let's first define various terms and plan types.

- Premiums: A premium is the amount the employee pays for their health insurance every month whether they use medical services or not.

- Deductible: The deductible is the amount the employee would pay out of pocket for covered services before their insurance plan starts to pay.

- Coinsurance: This is a percentage the employee is responsible for paying after they've reached their deductible. If the plan's coinsurance is 20%, the insurance company is responsible for 80% of the costs.

- Traditional health plan: A traditional health plan typically involves higher monthly premiums but also lower deductibles and coinsurance.

- High-deductible health plan (HDHP): An HDHP has higher deductibles than traditional health plans but often lower premiums. These plans qualify for a health savings account (HSA), which allows employees to save for future medical expenses.

- Health savings account (HSA): An HSA lets employees put money away for future health-care costs while saving on taxes. Account holders can realize tax savings because HSA funds are not taxed when used for qualified medical expenses. Contributions can come straight out of their paycheck, and the funds can grow tax-free. HSAs often feature employer contributions that can boost employee savings and help offset higher deductibles.

Advantages of HSA-compatible plans for employers

HSA-compatible plans can offer employers competitive advantages, laying the groundwork for a financially smart benefits strategy.

- Cost savings: HSA-compatible plans have lower premiums than traditional health plans for both employees and employers, so you can choose to put those savings into your employees' HSAs to encourage them to contribute as well. Plus, employee contributions through payroll deductions are made pre-tax, which saves you their portion of FICA taxes (7.65%).

- Potential tax benefits: Any time you contribute money to your employees' HSAs, 100% of those contributions are tax deductible.

- Employee support: By offering an HSA-compatible plan, you can support your employees in planning and saving for their health-care needs, promoting health and financial security.

- Advantages of HSA-compatible plans for employees: HSA-compatible plans benefit not just employers but also employees, who can gain a host of rewards when they enroll in an HSA.

- Lower premiums and higher take-home pay: HSA-compatible plans typically offer employees lower monthly premiums, leaving them with more of their paycheck to take home or they can use the extra funds to contribute to their HSA for future medical expenses.

- Tax savings through HSAs: Contributions to HSAs are made with pre-tax dollars, which lowers employees' taxable income. Plus, HSAs provide tax-free growth and withdrawals for qualified medical expenses.

- Control over health-care spending: HSAs put employees in the driver's seat, allowing them to pay for their care with pre-tax money, and encourages them to make informed and cost-conscious choices about their health care.

- Long-term savings: HSA balances roll over from year to year and the accounts remain in the employees' name and control, even if they change employers. And because HSA funds never expire, unused funds can help build a safety net for future qualified expenses. Employees can also choose to invest their HSA funds tax-free, similar to a 401(k).1

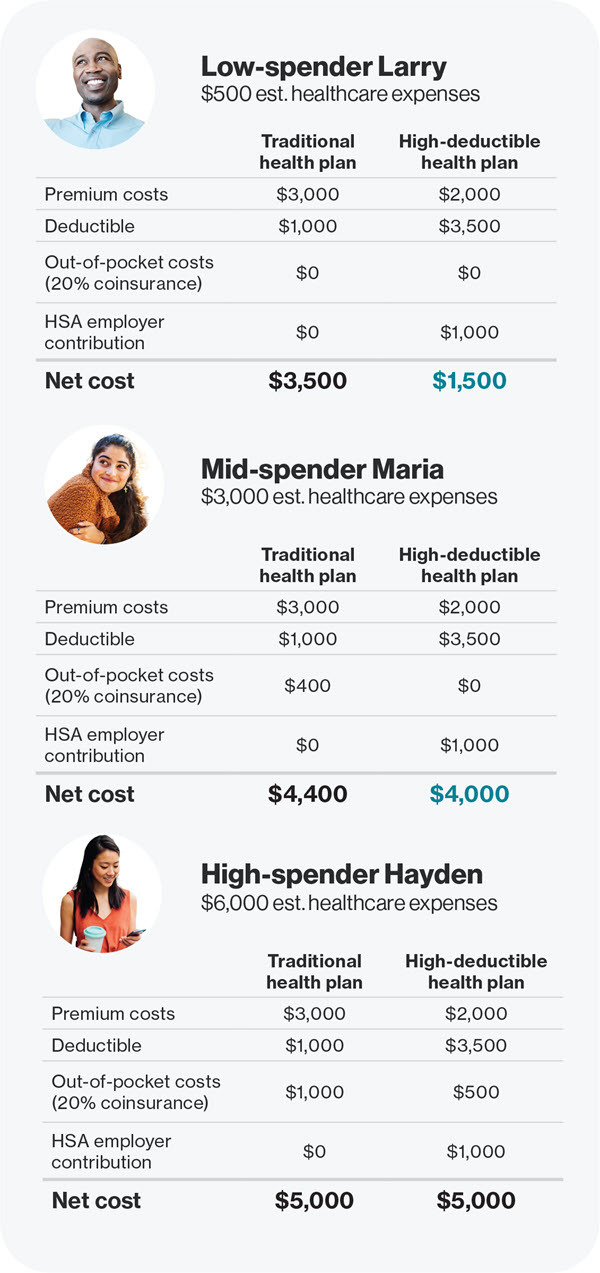

Checking the math: Comparing net costs for employees

Helping employees see beyond deductibles and understand their total costs can help them make more informed decisions.

Finding the net cost of a health plan

To calculate the net cost, employees should add up all their health-related expenses over the year, including premiums, and then subtract any employer HSA contributions and tax savings to get the true expense of their health plan.

Let's take a look at a few hypothetical scenarios for potential spenders.2

In each scenario, the HSA-compatible plan gives every person $1,000 in premium savings plus $1,000 free money with the employer's HSA contribution. So, the HSA-compatible plan saves $2,000 before even considering health-care expenses. This is why the plan is so appealing to folks like Low-spender Larry and Mid-spender Maria. But even for High-spender Hayden, the HSA-compatible plan is essentially breakeven.

Turn members into informed health-care consumers

Benefits can be confusing, but with the right support and education employees can become savvy health-care consumers. You can help them achieve that goal.

- Provide educational resources: Benefits materials that are easy to understand and available through a variety of channels can help employees better grasp health-care spending and the advantages of tax-advantaged accounts like HSAs, empowering them to make more informed benefits selections.

- Encourage proactive health-care management: Regular checkups and preventive health screenings can help employees take charge of their health, which can translate into long-term savings for both employees and employers.

- Promote financial wellness through HSAs: An HSA is more than a tool for health-care expenses; it's a way to align financial and health-care planning, encouraging overall health and financial wellbeing.

- Should you choose an HSA-compatible plan for your organization? The decision to select an HSA-compatible plan with an HSA option over a traditional health plan can feel daunting. A little guidance can help determine if an HDHP is right for your organization.

- Flexibility in benefits offerings: HSA-compatible plans can offer flexibility and unique advantages that may support the needs and preferences of your diverse workforce.

- Alignment with employee needs: Consider the demographics and health-care behavior of your employees. For some, an HSA-compatible plan may be the most cost-effective and beneficial choice.

- Competitive edge in recruiting talent: In today's competitive job market, offering attractive and affordable benefits to employees can give your business a significant edge in recruiting and retention.

HDHPs can save costs for both employers and employees

The switch to an HSA-compatible health plan can yield significant savings and benefits both for employees and employers.

The landscape of health benefits is evolving, and HSA-compatible plans offer unique advantages over traditional health plans. By carefully weighing the costs, tax benefits, and support they offer to employees, you can make an informed decision about which plan type best suits your organization and your employees' health and financial wellbeing.

To learn more, explore HealthEquity on ADP Marketplace.

About HealthEquity

HealthEquity and its subsidiaries administer HSAs and other consumer-directed benefits for over 15 million accounts, working in close partnership with employers, benefits advisors, and health and retirement plan providers who share an unwavering commitment to our mission to save and improve lives by empowering healthcare consumers. Through cutting-edge solutions, innovation, and a relentless focus on improving health outcomes, we empower individuals to take control of their healthcare journey while ultimately enhancing their overall well-being.

About ADP Marketplace

ADP Marketplace is a digital HR storefront that enables you to connect and share data across all your HR solutions. Simplify your HR processes, reduce data errors and drive your business forward with easy-to-use apps that integrate with your core ADP platform. Easily discover, try, buy and implement ADP and third-party solutions, all with the simplicity of single sign-on, single data input and single billing. Learn more at apps.adp.com.

1Investments made available to HSA holders are subject to risk, including the possible loss of the principal invested, and are not FDIC or NCUA insured, or guaranteed by HealthEquity, Inc. Investing through the HealthEquity investment platform is subject to the terms and conditions of the Health Savings Account Custodial Agreement and any applicable investment supplement. HSA holders making investments should review the applicable fund's prospectus. Investment options and thresholds may vary and are subject to change. Consult your advisor or the IRS with any questions regarding investments or on filing your tax return.

2The examples used are for illustrative purposes only. Individual results may vary.