Many businesses think that the only time they can change payroll providers is at the beginning of the year. In reality, you can switch whenever you’d like. We’ll show you how to navigate the transition and make it as smooth as possible.

Common concerns about midyear switches

- Will it disrupt my business?

The changeover should be efficient, with minimal interruption of your day-to-day operations. - Can they handle our complicated payroll processes?

An effective payroll service provider can address multiple pay frequencies, different employee classifications, a time and attendance system that isn’t integrated with your payroll system, or other software or manual processes. - Will it affect the timely filing of my taxes?

Full-service payroll providers will help you migrate your tax history and seamlessly process your taxes going forward.

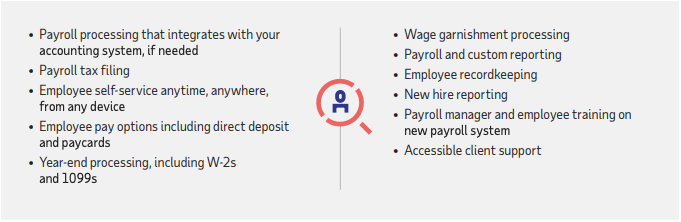

What to look for in a new payroll provider

For step-by-step tips on how to switch your payroll to a new provider, download ADP’s Midyear payroll conversion guide.

Go deeper

- Article ADP Payroll switcher’s guide