insight

Payroll setup: How to set up payroll

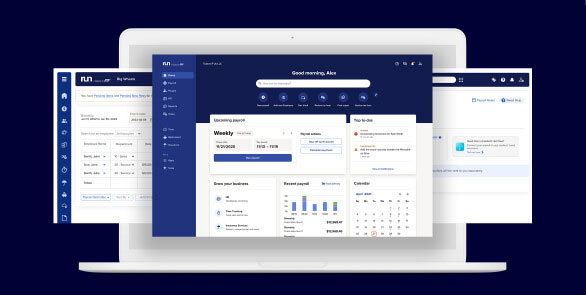

Interested in setting up payroll with a provider who can help save you time?

Setting up payroll is necessary for new employers who are hiring their first employee, as well as established businesses that are switching providers. Although there are quite a few steps to the process, taking the time to get it right from the beginning can help minimize the potential risk of tax penalties and compliance violations down the road.

Table of Contents

How to set up payroll – overview

A business’s prior experience with payroll will largely dictate the setup procedure. Employers who are simply switching payroll providers will have much of the groundwork already in place, while those who are completely new to the process generally have a bit more work to do. That said, there are seven steps to set up payroll:

- Sign up for an employer identification number (EIN)

- Classify workers

- Ask employees to complete withholding certificates

- Conduct open enrollment for benefits

- Decide on a payroll schedule

- Choose a payroll system

- Have a means of keeping accurate records

Seven steps for setting up payroll

-

Sign up for an employer identification number (EIN)

EINs are how the IRS identifies employers and as such, are necessary to pay taxes and file tax forms. Some states require separate ID numbers of their own.

-

Classify workers

Because employers are responsible for withholding taxes only for bona fide employees, they have to determine which, if any, of their workforce members may be independent contractors. They must then determine the exemption status of all employees. Those who classify as non-exempt from the Fair Labor Standards Act (FLSA) are entitled to overtime wages for hours worked in excess of 40 per workweek.

-

Ask employees to complete withholding certificates

Withholding certificates help employers calculate the correct amount of income tax to deduct from employee wages. Form W-4, Employee’s Withholding Certificate is used for federal income tax; states that charge income tax may use separate forms.

-

Conduct open enrollment for benefits

Employee contributions to health insurance premiums, retirement savings plans and other employer-sponsored benefits are typically withheld from their wages each pay period. Their selections, therefore, must be documented for payroll to properly account for them.

-

Decide on a payroll schedule

Employers should review state laws on pay frequency when developing a payroll schedule. If no requirements exist, employers are generally free to choose a payroll calendar that works best for both them and their employees. The most common types are bi-weekly and semi-monthly.

-

Choose a payroll system

Depending on their individual payroll needs, employers may decide to use traditional bookkeeping methods, hire an accountant, purchase payroll software or outsource the responsibility to a full-service payroll provider. Of all the options, working with a payroll provider like ADP is usually the best way to limit errors, save time and help reduce the risk of tax penalties.

-

Have a means of keeping accurate records

In addition to the payroll recordkeeping rules of the FLSA, many states have their own requirements, which may be stricter. Employers can save their payroll records in print or digital format to comply with the guidelines, or use online payroll software, which has the added security of cloud-based data storage.

Get payroll right from the beginning

Simplify your payroll setup with ADP. Quick, accurate and hassle-free.

What information do employers need to set up payroll?

Knowing the types of information that will be required in advance of a payroll setup can help make things run smoother and preserve peace of mind. Basic examples include, but are not limited to:

Employee information

- Name, mailing address, email address and Social Security number

- Bank account and routing numbers (if employee chooses direct deposit)

- Withholding certificates

- Copies of any existing garnishment orders

- Voluntary deductions (i.e., health insurance, retirement plans)

- Classification and exempt status

- Hourly rate or salary

- Job title, work location and date hired

Business information

- Legal name, address and doing business as (DBA) name, if applicable

- Federal, state and local tax ID numbers

- Bank account and routing numbers

- State unemployment (SUTA) account number and rate

- Workers’ compensation account number and rate

- Benefits summary plan descriptions and monthly insurance rates

Payroll information (if switching providers)

- Payroll frequency and next pay day

- Workweek start and end dates

- Year-to-date and quarter-to-date payroll data

Checklist of payroll setup forms and documents

Keeping track of all the documents required to set up payroll can be overwhelming. Here’s a list of some of the common forms that employers may need when either starting payroll or switching to a new provider:

- Form SS-4, Application for Employer Identification Number (EIN)

- Form W-4, Employee's Withholding Certificate

- Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding

- Form 5500, Annual Return/Report of Employee Benefit Plan

- Form 941, Employer's Quarterly Federal Tax Return

- Form 944, Employer's Annual Federal Tax Return

- Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return

- State and local tax forms, as necessary

Simplify your payroll setup, one form at a time

Check off every payroll form with ease. ADP can help you manage everything from EINs to tax filings.

Frequently asked questions about setting up payroll

How much does a payroll setup cost?

The cost to set up payroll depends on the type of payroll method chosen. Employers who take a DIY approach typically have minimal startup expenses, but may pay more later in tax penalties if their process is erroneous. Payroll service providers, on the other hand, offer superior accuracy, albeit for a fee. Most charge per-payroll processing or per-employee.

How do I set up payroll for one employee?

Except for the volume of information, setting up payroll for one employee is the same as it is for many employees. The basic steps for a first-time employer are:

- Apply for federal and/or state tax ID numbers

- Properly classify the employee as either exempt or non-exempt for FLSA and state wage and hour law purposes

- Gather all necessary details about the employee – tax withholdings, benefit selections, compensation rate, Social Security number, garnishment orders, etc.

- Create a payroll schedule that meets state law requirements

Choose a method of processing payroll and maintaining records

How do I deposit Social Security and Medicare taxes?

Employers generally deposit their Social Security and Medicare taxes monthly or semi-weekly, depending on their total payroll tax liability during a lookback period. In either case, the payments can be made online via the Electronic Federal Tax Payment System (EFTPS).

What is an example of a payroll fee?

Although payroll provider pricing structures are generally based on payroll frequency and total number of employees, there may be an annual or monthly base cost for additional services. One example of such a fee is year-end Form W-2 preparation and delivery.

Ready for 3 months FREE payroll?

Get 3 months free* when you sign up for payroll processing with ADP.

Next steps for setting up payroll

Getting started with ADP is simple. First, gather essential business and employee information like tax forms and EIN. Then, choose a payroll plan that fits your needs. ADP will guide you through the setup process, ensuring your system is compliant, accurate, and ready to run smoothly from day one.

Want more exclusive business insights like this delivered to your inbox?Subscribe now

1. ZipRecruiter is a registered trademark of ZipRecruiter, Inc.

2. Legal services are provided by Upnetic Legal Services, a third-party provider