Payroll software

for business

Easily run payroll, save time and keep your business compliant.

Payroll software that’s easy and affordable

Running payroll online is one of the most important aspects of any successful business, but that doesn’t mean it has to be stressful. With first-class payroll software, you’ll experience peace of mind knowing you have the resources to pay your employees and taxes correctly and on time.

ADP’s payroll software features:

24/7 access from any device

A user-friendly interface

Automated features

Features and benefits

In the cloud – and beyond

More than half of small firms with five or more employees pay an outside firm to prepare their payroll, according to the National Small Business Association1. Discover how ADP’s payroll software can help you improve your business operations.

Automated systems and reports save time and reduce errors

Processing payroll online is simple with ADP. Our payroll systems automate labor intensive tasks, such as:

- Calculations

- Tax withholdings

- Paper checks

- Digital payments

In addition, you can store all your employees’ information in our web-based interface. This drastically reduces the mistakes that can happen when entering data on a repeat basis.

An online payroll system for seamless integration

ADP’s payroll software easily syncs with time and attendance solutions and other human resource programs. So, from one place, you can manage not just payroll, but also benefits, employee absences, 401(k) contributions, insurance premiums and more.

Federal, state and local compliance

Never miss another filing with the government. Our payroll software makes sure all your paperwork is up-to-date and submitted on time. It also provides easy access to mandatory forms, such as W-2 and W-9, and notifies you about changes to minimum wage, tax codes and other regulations.

Support

When payroll issues arise, you need the right solution fast. ADP’s certified, experienced professionals are available to assist with all your payroll software needs.

Payroll software for any size business

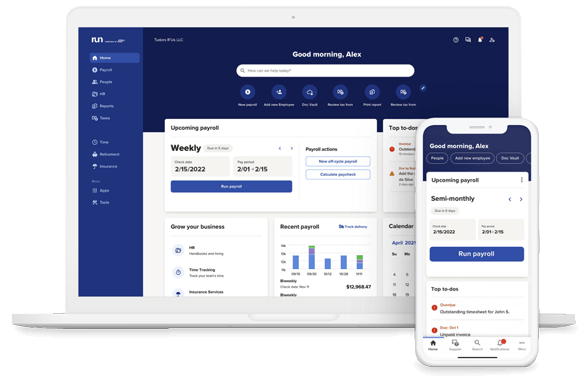

Built just for small businesses, RUN Powered by ADP® includes:

- Automated payroll

- Worry-free payroll tax filing

- Mobile access

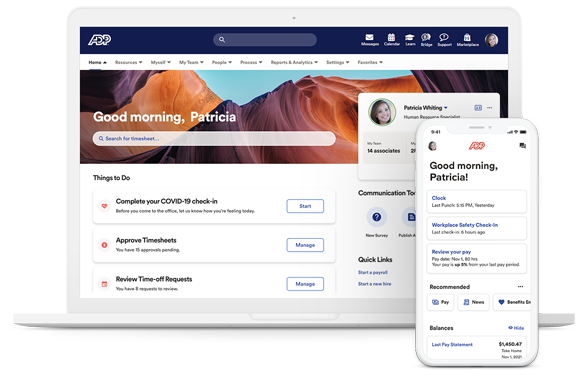

Just right for growing organizations, ADP Workforce Now® includes:

- Automated payroll

- Payroll tax filing and compliance

- Mobile access

Payroll software FAQs

- What does payroll software do?

-

Payroll software automates the most labor-intensive aspects of running payroll. Specific features vary from one provider to the next, but employers generally are be able to use software to:

- Calculate wages earned

- Integrate payroll with time and attendance

- Withhold taxes and other deductions

- Pay employees

- Run payroll reports

- Access important tax forms

Businesses that opt for full-service payroll may also receive professional assistance with regulatory compliance and have taxes filed on their behalf.

- What are the best payroll solutions?

-

No two payroll providers are the same, but most high-quality solutions generally can:

- Automate labor-intensive payroll and tax calculations

- Deposit tax payments on time

- Assist with inquiries from the IRS or state agencies, should they occur

- Help support compliance with constantly changing employment laws and regulations

- Integrate seamlessly with timekeeping, workers’ compensation, insurance services and other HR applications

- Provide support with unemployment claims

- Protect sensitive client payroll data

- What size organizations use payroll software?

-

Organizations of all sizes use payroll software, but what works for one may not be suitable for another. A small business may only need basic features that save time and help them with tax compliance. Larger corporations, on the other hand, tend to look for more advanced solutions that can integrate payroll with other HR systems or have advanced reporting capabilities.

- Can I do payroll without software?

-

Yes, payroll can be processed without software, but this is often a risky option for employers who don’t have the time or the accounting skills to do it correctly. The tax penalties that ensue from mistakes can quickly negate any savings achieved through DIY methods. For this reason, many businesses prefer to partner with a payroll service provider or explore outsourcing solutions.

- What do I need to run payroll at my company or organization?

-

Regardless of how employers choose to run payroll, whether through traditional bookkeeping or a software solution, the process requires a few basic elements to get started. These include:

- Federal and state employer identification numbers (EINs) for tax purposes

- Payroll schedules that meet state requirements, as well as the needs of the workforce

- A means of tracking employee time and attendance, especially if workers are hourly

- Payment methods and statements that comply with all state regulations

- A payroll manager to oversee the entire process of calculating wages and deductions, paying employees and filing taxes with government agencies on time

- What is the easiest payroll software to use?

-

Of the many types of payroll software on the market today, some are easier to use than others. Those that are user friendly will usually provide hands-on training, digital learning tools, dedicated account resources or in-product demos to ensure that their clients can run payroll as proficiently as possible. To make things even easier, payroll software may also be capable of integrating with timekeeping, insurance and retirement solutions, and other HR programs.

- How much does payroll software cost?

-

Payroll software costs vary depending on the number of people employed by the business, its individual needs and the provider’s price structure. An annual base price usually applies and there may be an additional fee for each payroll transaction. When weighing payroll software costs, it’s important to assess the level of support provided with the product and how well it can integrate with other programs.

- When can I begin using software for payroll?

-

With ADP, you can start processing payroll at any time, not just a new quarter or new year. If you’re switching providers, you can ease the transition process by asking for all the necessary forms and information upfront.

- Can I use this payroll software to run payroll internationally?

-

Not all types of payroll software can meet the complex needs of international businesses. Employers that pay employees in multiple countries generally require a payroll service provider that offers worldwide compliance expertise, on-demand analytics and reporting, and first-rate security measures. Some, like ADP, are also capable of unifying data into a single system of record, which helps make managing global payroll easier.

- What is the time commitment when processing payroll online?

-

Compared to manual data entry, online payroll software can save you considerable time. The features available in the package you choose will ultimately determine your total work effort.

- In the event of a catastrophe or local emergency, how will workers get paid?

-

You can process payroll anywhere because ADP products are in the cloud. So, even if you’re relocated from your place of business, ADP’s payroll software lets you easily use a mobile device to pay your employees.

- Can a payroll software service provider integrate with my accounting software?

-

ADP automatically syncs with many popular accounting software products, including QuickBooks™, QuickBooks™ Online, Xero™ and Wave, to ensure a seamless transition of your data. Check with a payroll provider to make sure they pair up with your preferred program.

- What if I’m already processing payroll with an accountant or bookkeeper?

-

Your accountant will probably appreciate that you’re using a trusted payroll service provider because it enables seamless data integration, reporting and payroll processing. This empowers accountants to do more work with greater efficiency, so they have more time to work on strategies that help you run a better business.

Payroll software testimonial

Payroll is so quick it saves me a ton of time. Setting up new employees is also obscenely simple. Everything from tax withholdings to direct deposits are done in 2 minutes, max. Such a time-saver that I don't need to hire an HR person or additional accounting person.

Daniel Ledbetter, Managing Director, Palmetto School of Career Development

Resources and insights

guidebook

How to choose a payroll provider for your business

guidebook

Payroll implementation guide

FAQ